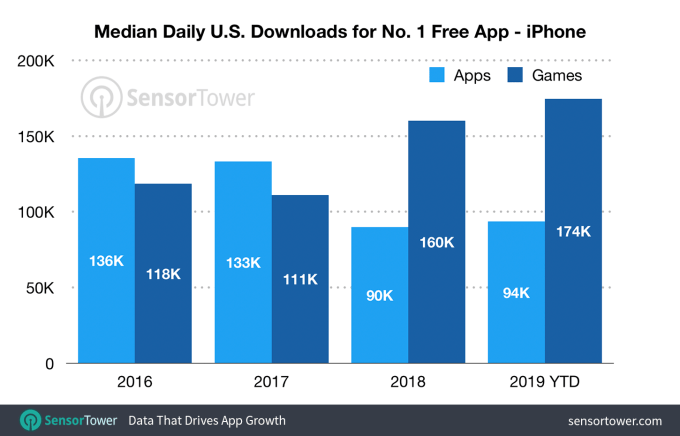

With the App Store’s big makeover in fall 2017, Apple attempted to shift consumers’ attention away from the Top Charts and more toward editorial content. But app developers still want to make it to the No. 1 position. According to new research from app store intelligence firm Sensor Tower, it’s become easier for non-game apps over the past few years to achieve the top ranking.

Specifically, the firm found that the median number of daily downloads required for non-game applications on the U.S. iPhone App Store to reach No. 1 decreased around 34%, from 136,000 to 90,000 in 2018, then increased a little more than 4% to 94,000 this year.

At the same time, the number of non-game installs on the U.S. App Store had increased by 33% between Q1 2016 and Q1 2019.

These findings, Sensor Tower suggests, indicate that the U.S. market for the top social and messaging apps has become saturated, with downloads for top apps like Facebook and Messenger decreasing over time. In addition, no other apps have found the same level of success that Snapchat and Bitmoji did back in 2016 and 2017, the report adds.

For example, Messenger saw 5 million U.S. App Store installs in November 2016 while Bitmoji and Snapchat passed 5 million installs in August 2016 and March 2017, respectively. And no other non-game app has topped 3.5 million installs in a single month since March 2017.

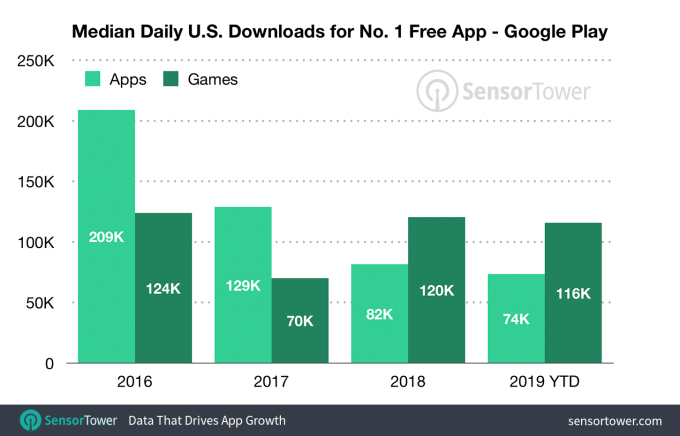

Meanwhile, the decline in downloads needed to reach the No. 1 spot on Google Play was even more significant.

The median daily downloads for the top non-game app decreased by 65%, from 209,000 in 2016 to 74,000 so far in 2019.

Similarly, the store saw a decrease in installs among top apps, including Messenger, Facebook, Snapchat, Pandora and Instagram. Messenger, for example, saw its yearly installs fall by 68% from nearly 80 million in 2016 to 26 million in 2018.

Games

With mobile games, however, it’s a different story across both app stores.

On the Apple App Store, it has taken 174,000 downloads for a game to reach the top of the rankings on any given day in 2019 — 85% more the 94,000 installs required for non-game app to reach the top of the charts.

This figure also represents an increase of 47% compared to the 118,000 median daily downloads required to top the charts back in 2016, Sensor Tower said.

In part, this trend is due to the rise of hyper-casual gaming. So far in 2019, 28 games have reached the No. 1 position on the U.S. App Store, with hyper-casual games making up all but four of those. And of those four, only Harry Potter: Wizards Unite spent more than one day at the top of the charts. Meanwhile, hyper-casual games like aquapark.io and Colorbump 3D have spent 25 and 30 days at No. 1, respectively.

On Google Play, the median daily installs to reach the No. 1 position increased from 70,000 in 2017 to 116,000 so far in 2019, or 66% growth. Overall game downloads, however, decreased 16% from 646 million in Q1 2017 to 544 million in Q1 2019.

Similarly, 21 out of the 23 games that reached the top spot this year have been hyper-casual titles, like Words Story or Traffic Run.

Breaking the top 10

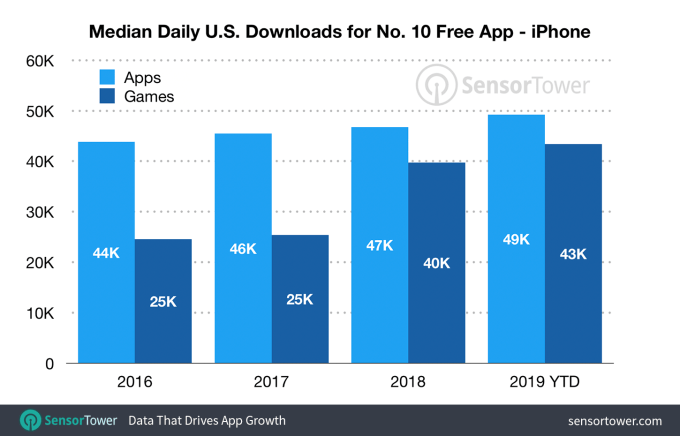

While topping the charts has gotten easier for non-game apps over the years, breaking into the top 10 has gotten more difficult. Median U.S. daily installs for the No. 10 free non-game app increased 11%, from 44,000 in 2016 to 49,000 in 2019.

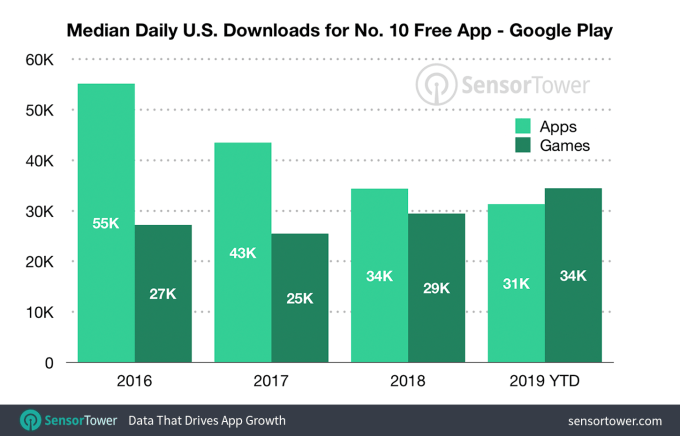

On Google Play, median daily installs for non-game apps fell nearly 50%, from 55,000 median daily installs in 2016 to 31,000 in 2019.

For games, the No. 10 game’s spot on the App Store increased from 25,000 median daily installs in 2016 to 43,000 so far in 2019, and Google Play saw 26% growth, from 27,000 to 34,000 during the same period.

Categories making the Top 10

In terms of breaking into the top 10 by category, Photo & Video apps on the App Store present the most challenge. The category where YouTube, Instagram, TikTok and Snapchat reside saw a median daily amount of more than 16,000 downloads for the No. 10 app.

This was followed by Shopping (15,300 daily downloads for the No. 10 app), Social Networking (14,500), Entertainment (12,600) and Productivity (12,400).

On Google Play, Entertainment apps — like Hulu, Netflix and Bitmoji — need around 17,100 U.S. installs in a day to reach the top 10. This is followed by Shopping (10,800), Social (9,100), Music (8,200) and Finance (8,000).

Beyond the U.S.

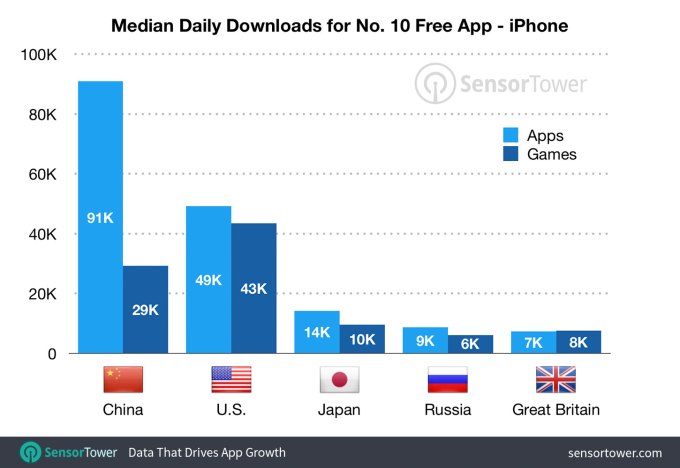

Outside the U.S., a non-game app needs approximately 91,000 downloads to reach the top 10 on the App Store in China — higher than the 49,000 installs needed in the U.S. For games, the U.S. is the most difficult to crack the top 10, with a median of 43,000 daily downloads for the No. 10 game.

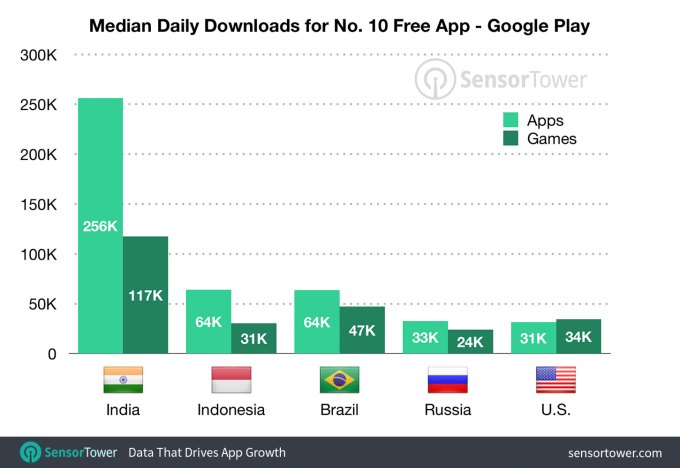

On Google Play, India required the most downloads to reach the top 10, with apps needing 256,000 downloads in a day and games needing 117,000 downloads.

Of course, the App Store’s ranking algorithms — nor Google Play’s algorithms — don’t rely on downloads alone to determine an app’s ranking. Apple takes into consideration downloads and velocity, among other undocumented factors. Google Play does something similar.

But these days, developers are more concerned with showing up highly ranked in app store searches than they are on top charts, where they’ll need to consider numerous other factors beyond downloads — like keywords, description, user engagement and even app quality, among other things.

[“source=techcrunch”]