Apple Inc.’s App Store has turned countless software developers into millionaires since its launch almost a decade ago. But working with the famously controlling company has often been frustrating. Apps were rejected with little explanation, and Apple has been stingy about sharing customer data that could have helped developers improve their products.

Apple Inc.’s App Store has turned countless software developers into millionaires since its launch almost a decade ago. But working with the famously controlling company has often been frustrating. Apps were rejected with little explanation, and Apple has been stingy about sharing customer data that could have helped developers improve their products.

Apple can no longer afford to brush off the developer community. With sales of iPhone, iPad and Macs slowing, the company is under pressure to extract more revenue from services, a bright spot that includes the apps business. Apple needs to ensure that the next generation of apps—especially ones selling a service that’s used everyday—are made for iOS rather than such competing platforms as Google Play.

In recent months, Apple has made a number of concessions to developers. The company has built analytical tools that provide insights into how apps are used and monetized, sped up the approval process for new ones, halved its take for many transactions in the App Store and made it easier for developers to sell subscriptions. (The shift is the subject of the latest episode of the Decrypted podcast; subscribe here on iTunes.)

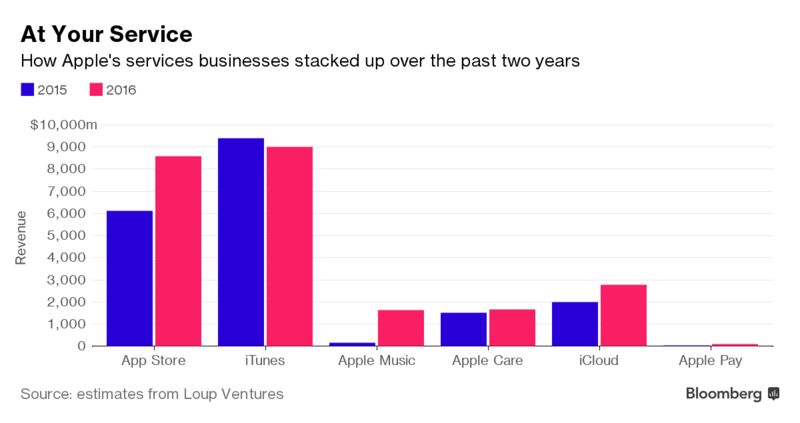

Services are an increasingly important piece of Apple’s business, with revenue surging 22 percent to $24 billion last year. The standouts are the App Store, where revenue increased by 40 percent to $8.6 billion, and the Apple Music subscription service, whose sales surged to $1.6 billion in its first full year, according to estimates from Gene Munster, who runs Loup Ventures and covered Apple as an analyst for many years.

Chief Executive Officer Tim Cook has been talking up the services business in quarterly conference calls. “We expect the revenues to be the size of a Fortune 100 company this year,” he said in January, predicting that the business, which include iTunes and Apple Care, will double in size by 2021. Apple shares rose less than 1 percent to $142.34 at 10:45 a.m. in New York.

For years, app developers have complained that Apple dictated what they could and couldn’t do and rarely explained the decision-making process. Kushal Dave, who was once a senior engineer at FourSquare and is now working on a new project, says small apps just starting out were particularly vulnerable and could get “totally stuck at any given time” because so much was up to “Apple’s whim.”

Apple wasn’t deaf to the complaints. Engineers at the company had been pushing their bosses to provide more data to the app developer community since at least 2013, according to someone familiar with the company’s deliberations. They felt Apple needed to close the gap with Alphabet Inc., whose Google Play store has long approved apps faster than Apple and provided rich analytical detail on their usage.

Phil Schiller unveils the new iPhone 7 during an event in San Francisco on Sept. 7, 2016.

About fifteen months ago, Cook took the App Store away from Eddy Cue, the senior VP of internet software and services, and handed it to marketing chief Phil Schiller, who had been running developer relations for years. Schiller got busy. By May of last year, developers noticed that Apple was approving their apps much more quickly than before. Rather than a week or more, it was now taking less than two days to get an app greenlit.

“If there’s something we need to fix or we want to get out an additional update, we don’t have to worry about waiting a week or two weeks any more and that’s been hugely positive for us,” says James Vaughan, whose Ndemic Creations sells a mobile game called Plague Inc. in which players aim to wipe out the world’s population.

Suddenly, Apple became more willing to share usage data. Now, developers don’t have to rely on gut instincts, which can often be wrong, or waste time trying to scrape up the information themselves. Instead, they can fine-tune their products on the fly. Yuval Kaminka, whose JoyTunes makes apps that teach kids how to play the piano, says he can now see what prompts people to subscribe, when they convert from trial runs to paid subscriptions and when they’re cancelling. The Apple tools helped his business grow seven-fold last year. “We know what’s working much sooner,” Kaminka says.

Apple will continue to roll out new data tools; in the coming weeks, developers for the first time will be able to respond to customer reviews in the App Store. The company has also tried to tailor app recommendations to individual users.

Over time, how Apple monetizes apps could turn out to be the most important change. It’s not just that the company has halved its 30 percent cut once a customer has subscribed to an app for 12 months. It’s that Apple has opened the subscription model to new app categories. In the past, subscriptions were mostly the preserve of content companies such as Netflix and management apps like Dropbox. Now a host of apps can charge subscription fees for everything from games to photo-editing tools to fitness.

Itai Tsiddon figures selling subscriptions could boost the revenue of his photo-editing apps Facetune and Enlight 10-fold. Last year his company, Lightricks Ltd., sold about 10 million apps and generated about $10 million in sales. By attracting four million subscribers, Lightricks could surpass $100 million in revenue, Tsiddon reckons. “For us, that’s what’s exciting about this new model,” he says. “The more proficient you are, the more value you can get from a tool over time. So a subscription model really works.”

Global smartphone sales grew at the slowest pace on record last year, so Apple is in a duel for the customers of such rivals as Samsung Electronics or Huawei Technologies. App subscriptions help Apple keep people loyal.

Investors value Apple shares at an estimated 16 times earnings, compared with 21 times for Alphabet and 174 times for Amazon.com Inc. To merit a valuation that brings it closer to its peers, Apple will have to bring recurring revenue closer to that of its tech rivals.

“To me this change means that Apple is serious about building bigger businesses that depend on the App Store ecosystem,” says Kaminka. “I think it’s a very big bet on their part.”